Taking the guesswork out of common SME topics so you can get it “right first time”. In this article we look at the rules regarding entertainment expenses.

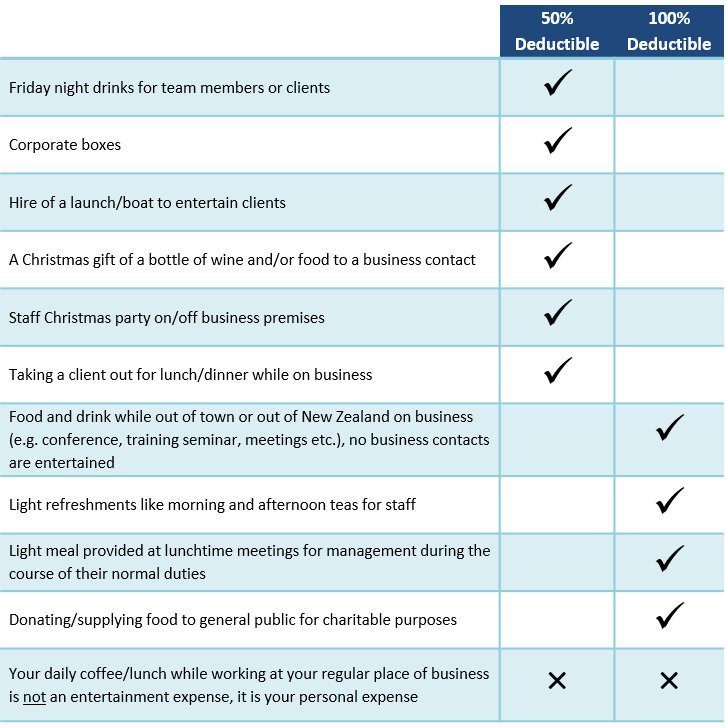

There is often confusion around which expenses can be claimed under ‘Entertainment’ and what is the tax deductibility criterion. Certain entertainment expenses are 100% deductible, while some are 50% deductible. Sometimes they can be private (making them 100% non-deductible). In general terms, if you spend the money to help your business earn income, then the expense can be classed as business related but the rules must be applied to work out if they are 100% deductible or only 50% deductible.

We recommend seeking professional assistance if you are unsure because it may be necessary to make a judgement on a case-by-case basis.

A few common examples of expenses that are deductible are:

If you make mistakes with your business expenses, you may be charged penalties and any unpaid amounts are liable for interest. Remember, when in doubt speak to your friendly accountant for advice – contact us today!