Your year-end accounts shouldn’t be just an annual exercise that you and your accountant go through to placate the IRD. They do, in fact, offer essential insights into how your business is performing and provide an opportunity to make changes to improve future performance. In this beginner’s guide to understanding your balance sheet, we take a look at the main elements of a typical balance sheet and how to use them to calculate simple ratios that allow you to better understand your business’ financials.

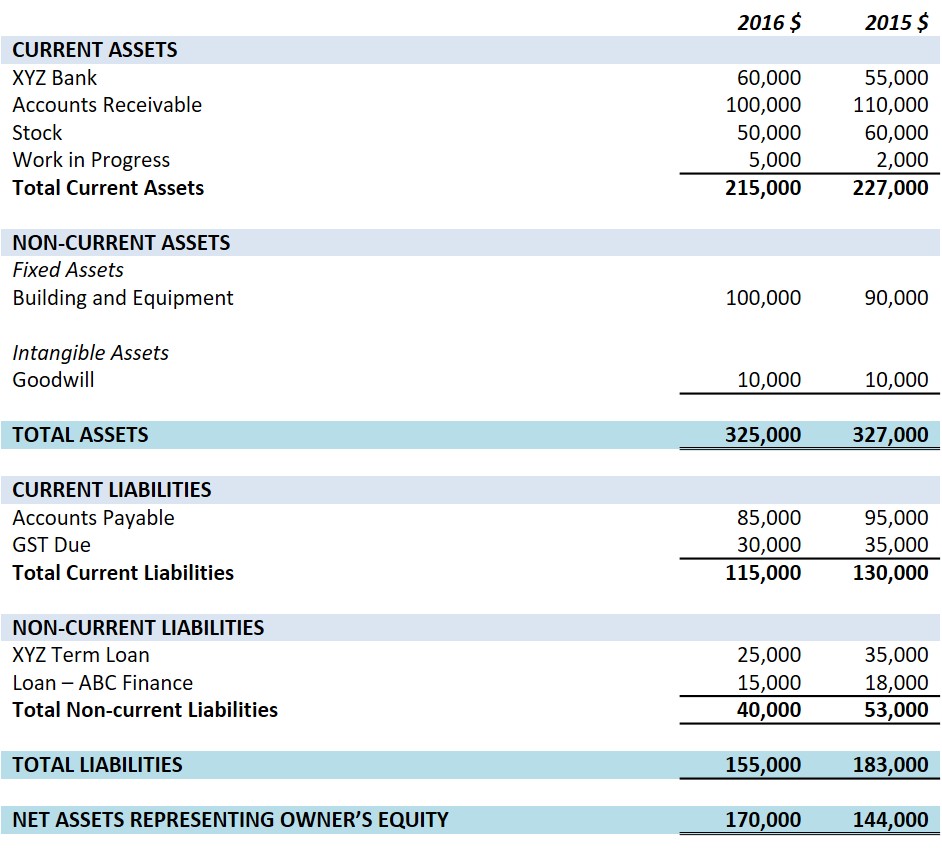

Balance sheets provide a snapshot of a business’ assets, liabilities and owner’s equity at your balance date. They tell you how much a business owns, owes, and what it is worth compared to the previous year.

Assets = Liabilities + Owner’s Equity

Assets

Assets are things a business owns that have value.

Current assets are those items that can be readily turned into cash (generally within a year), such as stock, accounts receivable and cash in the bank.

Non-current or fixed assets are long-term assets often used to operate the business but not available for sale, such as buildings, equipment, vehicles, land and office equipment.

Intangible assets are a third category sometimes included in the balance sheet, such as trademarks, patents and goodwill.

Liabilities

Liabilities are what a business owes to others.

Current liabilities are those items you are expected to repay within one year, such as accounts payable, bank overdrafts, and any taxes due (GST, provisional or terminal tax).

Non-current or long term liabilities are items the business owes but fall due in more than one year, such as long term loans and long term hire purchase agreements.

Owner’s Equity

Owner’s equity, or shareholder’s equity, is the balance that would be left if a business sold all of its assets and paid all of its liabilities, and includes owner(s) investment and any accumulated profits left in the business as retained earnings.

Using The Balance Sheet

In understanding your balance sheet, we now take a look at some of the ratios you can calculate to gain valuable insights into the financial position of your business.

Solvency

Solvency, or liquidity, is a business’ ability to repay its debts. There are simple ratios you can calculate to identify the level of solvency.

- Current ratio: divide current assets by current liabilities. Aiming for a minimum ratio of 2 to 1 (or $2 in assets for every $1 in liabilities), shows that a business is able to meet its short-term commitments without risking cash shortages or seeking additional funding.

- Quick ratio: divide current assets minus stock by current liabilities. This is a tougher measure of solvency as it omits stock with the theory that it is difficult to convert it quickly into cash. For businesses with a lot of stock on hand, aiming for a minimum ratio of 1 to 1 is recommended.

Financial Position

A balance sheet can show whether a business’ financial position is strengthening or weakening by calculating the equity to assets (or ownership) ratio. Dividing owner’s equity by total assets (less any intangible assets) shows how much of the business the owner actually owns. Aiming for a minimum ownership ratio of 40% can help avoid being undercapitalised and minimise the risk of having too much debt.

Reliance On Debt

Calculating the debt to equity ratio by dividing total liabilities by total equity will show the extent to which a business relies on debt to finance its growth. In very general terms, a high debt to equity ratio may indicate that a business has aggressively financed its growth with debt. On the other hand, a low debt to equity ratio may be a symptom of a business not taking advantage of increased profits for financial leverage.

Although the balance sheet shows a static view of assets and liabilities, the movements around these are also reflected in income and expenses on the profit and loss statement. Financial statements are all related and work together to give a rounded view of a business’ financial health.

As always, please contact us if you have any questions regarding understanding your balance sheet or any aspect of your year-end accounts.