Case Study

Ian recently started a trade business. His family was very supportive of his decision but had some concerns initially due to their high mortgage repayments and kids’ schooling requirements. Whilst completing a customer’s job, Ian had a major accident that rendered him unable to work for three months. Ian had forgotten to purchase insurance, and had to drawdown on the family’s entire savings and the equity in their home until he was able to return to work.

Are You At Risk From A Triggering Event?

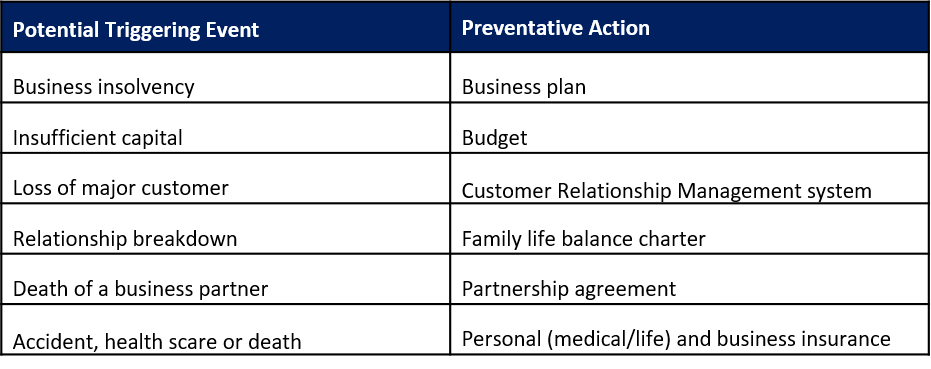

A triggering event is one that occurs which significantly impacts on your personal, family and business situation. Small business owners can take preventative action to minimise the impact of a triggering event.

Potential Triggering Events And Preventative Actions

How Much Business Insurance Do You Need?

Purchasing insurance is one way of minimizing your risk from a triggering event occurring. Typical small business insurance usually includes:

- Key Person Insurance – to provide for a lump-sum payment if death occurs

- Sickness and Accident Insurance – to replace a loss of income

- Trauma and Permanent Disability Insurance – to provide a lump-sum payment if a traumatic health event occurs which causes disability.

When purchasing insurance it is important to make sure you are sufficiently covered for personal, family and business situations. Your Accountant or Financial Adviser is usually in the best position to assess your current and future needs and advise on your insurance requirements.

UHY Haines Norton Director Kerry Tizard works with business owners to protect and increase the value of their businesses. To find out more please contact Kerry on (09) 839-0300 or email kerryt@uhyhn.co.nz.