Our previous article “Ring-fencing Of Residential Rental Property Losses” explained what these rules are and the circumstances under which they apply. Now we take a look at these residential ring-fencing rules and mixed-use assets.

Our previous article “Ring-fencing Of Residential Rental Property Losses” explained what these rules are and the circumstances under which they apply. Now we take a look at these residential ring-fencing rules and mixed-use assets.

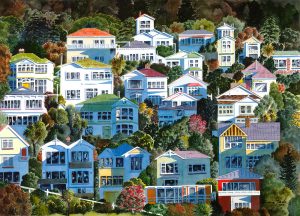

A common mixed-use asset scenario is where a person owns a rental property that is rented out for short-term accommodation as well as being used by the owners as a holiday home. If a property is vacant for more than 62 days of the year and is used for both income-earning and private use, it is subject to mixed-use asset rules.

The residential rental property ring-fencing rules do not apply to residential land that is a mixed-use asset. Instead, the mixed-use asset rules limit deductions in relation to the property and include provisions by which any excess expenditures, after they have already been limited in deductibility, may be ‘quarantined’ until a future year when there is surplus rental income to offset the quarantined portion of the reduced expenditures.

Please contact us if you would like more information regarding residential ring-fencing rules and mixed-use assets.