ACC is like a mandatory insurance policy for businesses that covers business owners and staff for personal injury.

There are four types of ACC levies that businesses may pay:

- Work Levy – paid by businesses based on PAYE employees’ wages to cover workplace injuries.

- Earners’ Levy – paid by all active income earners to cover injuries outside of the workplace such as injuries that happen at home or sports injuries.

- The Working Safer Levy – collected on behalf of WorkSafe New Zealand to support their activities in injury prevention across the country.

- Motor Vehicle Levy – paid via petrol pump charges and vehicle licenses/registrations to cover injuries on public roads involving moving vehicles.

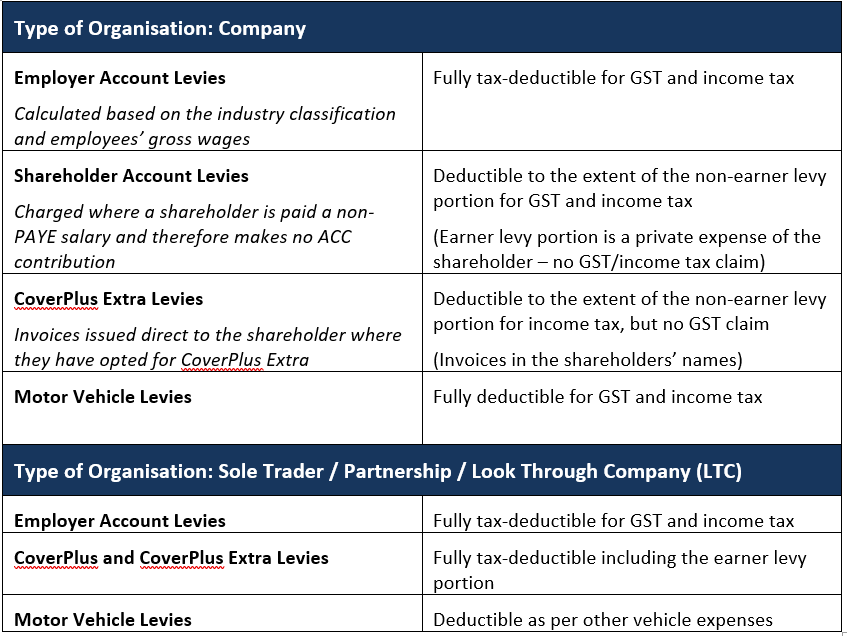

So although the levies are compulsory, the good news for businesses is that generally these ACC levies are a deductible business expense. The extent to which they are tax-deductible depends upon the type of levy and the type of organisation.

Please contact us if you have questions regarding the tax-deductibility of ACC levies, or if you have concerns of being over-charged based on the maximum income threshold ($130,911 for the 2021 financial year).