A major tax difference between commercial and residential buildings is that for commercial you can claim depreciation on your building.

Depreciation for buildings was removed across the board in 2010, then reinstated – but only for commercial buildings – as part of a 2020 emergency pandemic support package.

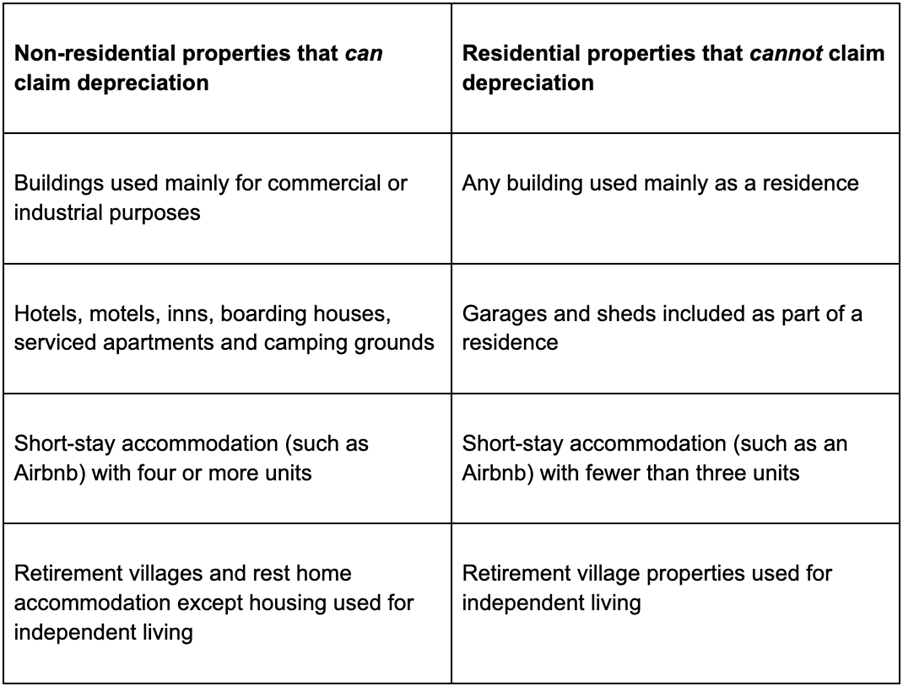

Residential landlords cannot claim depreciation, but there are some grey areas where it’s not immediately obvious whether a building is residential or not. Inland Revenue has recently released a fact sheet to help you find the right depreciation rate for your building.

Does your property qualify as non-residential?

Here are the criteria according to the Fact Sheet:

Claiming depreciation can save you a considerable amount. For instance, IRD provides an example of a motel building with a tax book value of $3 million. The depreciation rate of 2% means the company can claim a $60,000 deduction, paying $16,800 less tax. If your building is non-residential, you can also depreciate the fit-out.

If you have questions about how to claim depreciation on your building, your fit-out or various tax deductions on any properties, please get in touch with us – we’re here to help.

This publication has been provided as general information associated with the topics covered. It is not intended to be specific advice. We strongly recommend readers seek independent advice from a suitably qualified professional adviser prior to acting in relation to any of the matters discussed in this publication. No person or entity involved in this publication accepts any liability for any loss or damage whatsoever which may directly or indirectly result from any advice, opinion, information, representation, or omission, whether negligent or otherwise, contained in this publication.