If you are in business one of the most useful things you can do with your bank accounts is set up a separate account for tax. Setting up a separate bank account and regularly putting money into it will ensure you can pay your tax bills on time and avoid costly penalties and interest. For example, when your invoices are paid, if you are GST-registered we recommend separating out the GST portion of your invoices into your tax bank account. And likewise when you complete your payroll, transfer the PAYE owing into your tax bank account. You can also pay extra into the account at times when your cash flow is particularly healthy to be used towards your provisional tax bill.

If you are in business one of the most useful things you can do with your bank accounts is set up a separate account for tax. Setting up a separate bank account and regularly putting money into it will ensure you can pay your tax bills on time and avoid costly penalties and interest. For example, when your invoices are paid, if you are GST-registered we recommend separating out the GST portion of your invoices into your tax bank account. And likewise when you complete your payroll, transfer the PAYE owing into your tax bank account. You can also pay extra into the account at times when your cash flow is particularly healthy to be used towards your provisional tax bill.

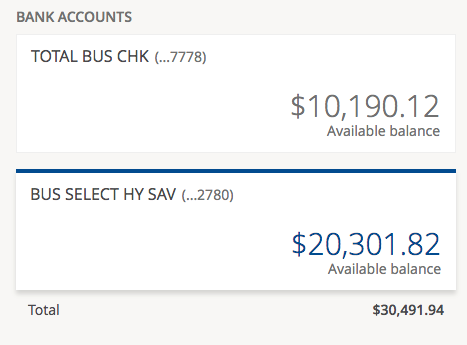

Late fees and interest on tax owing can have a real sting on small businesses, and those tax bills seem to come around far too often. Using a separate bank account helps you to avoid accidentally spending that tax owing on other business expenses. Plus if your tax bank account is set up as a high-interest account you can put the interest accrued towards other bills (such as ACC or insurance).