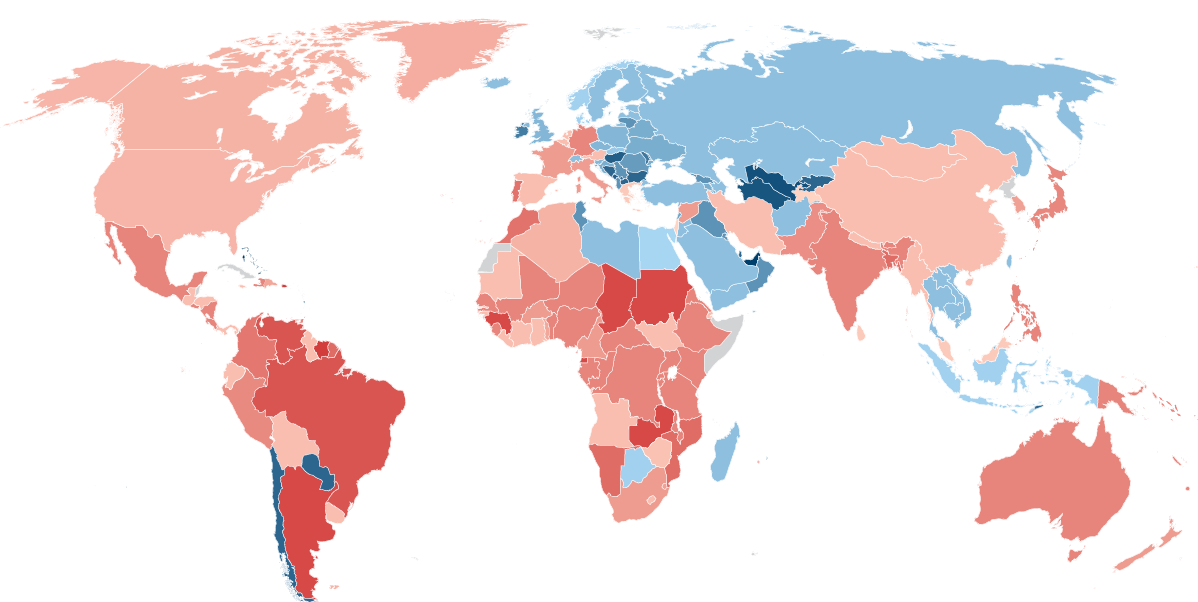

Corporate tax rates worldwide hit new low of just 25.1% – but new trend of rising rates has already begun

However, with the Covid-19 pandemic leaving a gaping hole in the public finances of countries around the world, UHY says that the trend of declining corporate tax rates worldwide is likely to be over for the foreseeable future.

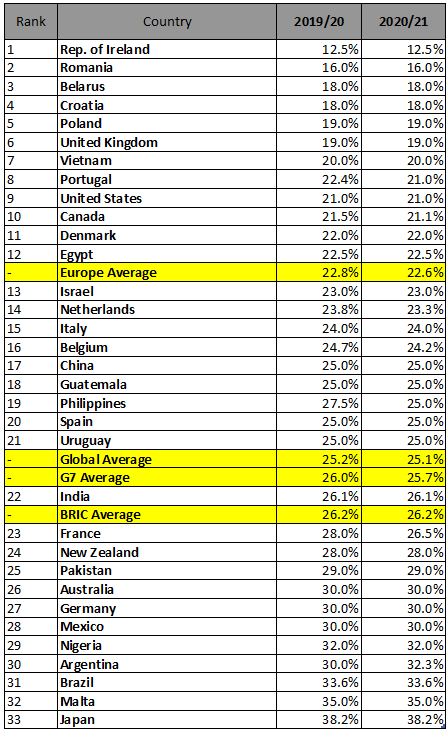

The UK government already announced its intention to raise corporation tax rates to 25% from April 2023, more than two percentage points higher than the European average. Argentina already increased its headline corporate tax rate from 30% to 35% in 2021. US President Joe Biden has also pledged to raise federal corporate income tax to 28%, after it was cut to just 21% by his predecessor Donald Trump in 2017.

Global corporate tax rates have been steadily decreasing over recent years, with the G7 average for a business recording profits of 1 million USD falling from 32% in 2014/15 to just 26% in 2020/21. Many countries sought to incentivise businesses to invest in their economies with attractive tax rates. France, often seen as a higher tax European economy, has lowered its headline rate from 31% to 26.5% in just the past three years.

Subarna Banerjee, Chairman of UHY, comments: “Countries around the world have wanted to remain competitive by keeping the tax burden on companies as low as possible in recent years. The cash strapped governments of 2022 will likely now be considering increasing taxes on corporates.”

“Public finances will have to be shored up somehow and corporates can be an easier target politically than individuals. Businesses worldwide should be prepared for their tax costs to begin to rise in the coming years.”

Lower rates for SMEs remain vital, says UHY

UHY says that governments worldwide should ensure that any move to raise corporate tax rates does not affect the lower rates used to encourage the growth of SMEs. The Netherlands has recently reduced its corporation tax rate to just 16.5% for companies with taxable income under $450,000, while Croatia now offers a rate of just 10% for companies with a turnover of less than $1,125,000.

UHY explains that SMEs form the foundation of economies worldwide, employing millions of people and a path to sustainable economic growth. Encouraging SME development with tax incentives will be crucial to the post-covid recovery of both developed and developing nations.

Subarna Banerjee continues: “SMEs are a crucial component of international economies. In light of many countries’ post-covid recovery plans, it is encouraging to see so many continuing to support these smaller enterprises which form sustainable foundations of their economies.”

OECD’s global minimum tax rate may prevent further tax rate cuts

The OECD announced in October that 136 countries have signed up to a deal to enforce a minimum corporate tax rate of 15% from 2023. The deal will also allow countries to tax multinationals that make sales within their jurisdictions even if they do not have a physical presence there.

As a result of growing political pressure, some lower-tax jurisdictions will likely now have to increase their corporate tax rates for multinationals. Countries such as the Republic of Ireland have come under fire for their low corporate tax rate of just 12.5%.

These corporations are a key target for government clampdowns worldwide, with some multinationals choosing to operate from lower-tax countries, resulting in them recording lower profits in higher-tax countries.

Alan Farrelly of UHY Farrelly Dawe White Ltd says: “In the last two decades there has been global competition amongst countries such as the Republic of Ireland offering the lowest corporation tax rates. The new OECD initiative will change this trend for countries utilising low corporation tax rates to attract foreign investment.”

Could more corporate tax hikes be possible?

Developing nations surveyed by UHY typically already had higher corporate tax rates than their more economically developed counterparts. India’s tax rates hit 34% for the largest corporations, with Nigeria implementing a headline rate of 32%, and Argentina charging its resident companies 35% on their profits.

Experts question whether there is scope for some countries to raise taxes further. Japan already charges its companies up to 38.2%, and Malta has similarly high rates at 35%.

Lomme van Dam of Govers Accountants in the Netherlands says: “Governments should carefully balance their tax deficits with their economic recovery. Businesses paying punitively-high tax rates could lead to slower growth in employment, revenues and ultimately tax receipts.”

Global corporate tax rates fall to an average of just 25.1%

* According to the average tax rates of 33 UHY international firms, assuming companies have a profit of $1 million