It’s common for businesses to spend money on entertaining customers as a way of showing appreciation for their custom and encouraging loyalty. However, deciphering whether client entertainment expenses are non-deductible, 50% tax deductible or 100% tax deductible in line with the IRD’s rules can be a real challenge.

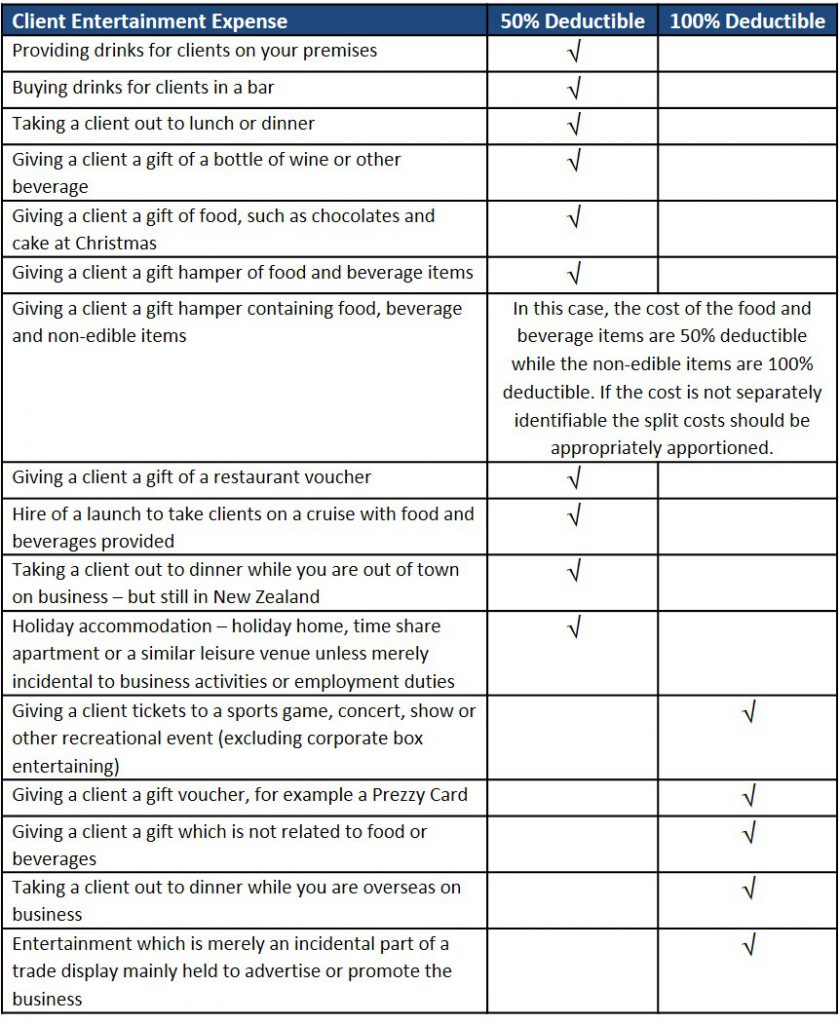

From the IRD’s perspective, the types of expenses classed as “entertainment” include food, drink, social events and generally anything of entertainment, amusement or recreational value. Some client entertainment expenses are 50% deductible while others are 100% deductible depending on the specific circumstances.

For more information on entertainment expenses in general, please see our Business Basics brochure on Entertainment Expenses.

UHY Haines Norton are experts in deciphering and managing client entertainment expenses. Please contact us to find out how we can help you.